Table of Contents

Introduction

If you’re planning to start a business in India, company registration is the first and most crucial step. It gives your business a legal identity, builds credibility with stakeholders, and opens the door to multiple growth opportunities like fundraising, government tenders, and tax benefits.

This comprehensive guide on company registration in India walks you through everything—from types of companies, required documents, step-by-step procedures, government fees, to post-registration compliances.

What is Company Registration?

Company registration is the process of incorporating a business entity under the Companies Act, 2013. It involves legally creating a separate legal entity recognized by law with a unique name, PAN, and CIN (Corporate Identification Number).

Once registered, the company becomes a juristic person, independent of its shareholders or directors, capable of owning property, entering into contracts, and suing or being sued in its own name.

Benefits of Company Registration in India

- Limited Liability Protection: Shareholders’ personal assets are protected.

- Legal Recognition: A registered company is a separate legal entity.

- Fundraising Opportunities: Eligible to raise funds via equity or debt.

- Brand Credibility: Customers and investors trust a registered company more.

- Perpetual Succession: The company continues even if ownership changes.

- Tax Advantages: Certain benefits and deductions under the Income Tax Act.

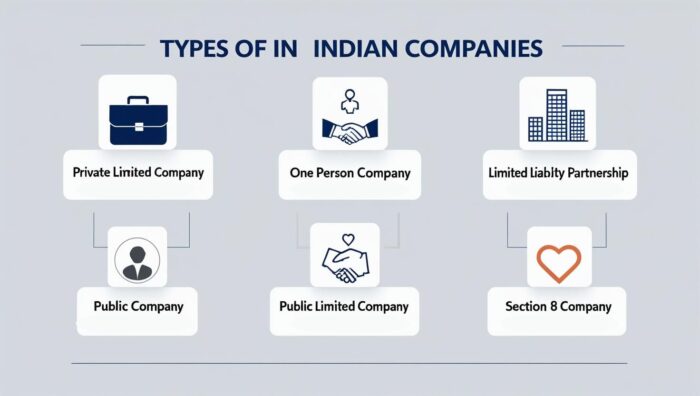

Types of Companies You Can Register in India

Before proceeding with company registration, it’s vital to choose the right business structure. Below are the commonly registered entities:

1. Private Limited Company

- Minimum 2 shareholders and 2 directors

- Limited liability

- Suitable for startups and scalable businesses

- Eligible for Startup India benefits

2. One Person Company (OPC)

- Single promoter

- Limited liability

- Best suited for solo entrepreneurs

3. Limited Liability Partnership (LLP)

- Minimum 2 partners

- Combines benefits of a company and a partnership

- Less compliance than a private company

4. Public Limited Company

- Minimum 7 shareholders and 3 directors

- Can raise funds from the public

- Subject to higher compliance

5. Section 8 Company (NGO)

- Non-profit objectives

- Promotes commerce, arts, education, etc.

- Income is tax-exempt

Documents Required for Company Registration

To register a company in India, the following documents are typically required:

For Directors/Shareholders:

- PAN Card (Mandatory for Indian citizens)

- Passport (For foreign nationals)

- Aadhaar Card

- Voter ID/Driving License (as ID proof)

- Latest Bank Statement/Electricity Bill/Phone Bill (as address proof)

- Passport-size photographs

For Registered Office:

- Rent Agreement (if rented)

- NOC from Owner

- Electricity Bill/Property Tax Receipt (not older than 2 months)

Step-by-Step Process of Company Registration in India

Here is the updated step-by-step guide for company registration in India as per MCA norms:

Step 1: Obtain Digital Signature Certificate (DSC)

All proposed directors must have a DSC for signing e-forms online. It is issued by certifying authorities and is valid for 1–2 years.

Step 2: Apply for Director Identification Number (DIN)

DIN is a unique identification number for directors. If you’re filing for company incorporation through SPICe+ form, DIN is allotted automatically to the proposed directors.

Step 3: Name Approval through SPICe+ Part A

Choose a unique name that complies with MCA guidelines. Apply for name reservation via SPICe+ Part A form on the MCA portal.

Tips for Name Approval:

- Avoid identical or too similar names

- Add suffix like “Pvt Ltd”, “LLP”, or “OPC Pvt Ltd”

- Conduct a name search on MCA and trademark database

Step 4: File SPICe+ Part B (Incorporation)

After name approval, file SPICe+ Part B which includes:

- Company incorporation form

- Director details

- Share capital

- Registered address

Linked forms include:

- AGILE-PRO-S: For GST, EPFO, ESIC, Profession Tax (in Maharashtra), and Bank Account

- e-MOA and e-AOA: Digital MOA and AOA submission

- INC-9: Declaration by directors

Step 5: PAN, TAN, and Bank Account

With SPICe+, PAN and TAN are issued automatically. The company also receives a zero-balance current account opening offer from authorized banks via AGILE-PRO.

Step 6: Certificate of Incorporation (COI)

Upon verification, the Registrar of Companies (RoC) issues the Certificate of Incorporation, which includes:

- Company’s CIN

- PAN

- TAN

- Date of incorporation

Cost of Company Registration in India

| Expense Head | Approximate Cost (INR) |

|---|---|

| DSC (2 Directors) | ₹2,000 – ₹3,000 |

| Government Filing Fee | ₹1,000 – ₹2,500 |

| PAN & TAN Application | Included in SPICe+ |

| Professional Fee (optional) | ₹2,000 – ₹10,000 |

| Stamp Duty (varies by state) | ₹1,000 – ₹5,000 |

| Total Estimate | ₹6,000 – ₹20,500 |

Note: The cost may vary depending on state, capital amount, and professional involvement.

Post-Registration Compliances

After successful company registration, the following compliances must be ensured:

1. Open Company Bank Account

Use the COI, PAN, and AoA/MoA to open a current account in the company’s name.

2. Commencement of Business (Form INC-20A)

Mandatory for companies with share capital to file within 180 days from incorporation. A declaration of receipt of share subscription money must be made.

3. GST Registration

Mandatory if turnover exceeds threshold or in case of inter-state sales. Can be applied during incorporation via AGILE-PRO-S.

4. Appointment of Statutory Auditor

Within 30 days from the date of incorporation.

5. Board Meetings and Records

First board meeting must be held within 30 days. Maintain minutes, attendance register, and statutory registers.

6. ROC Annual Filings

File:

- Form AOC-4: Financial Statements

- Form MGT-7: Annual Return

7. Income Tax Return (ITR)

File company’s ITR annually even if there’s no income.

Common Mistakes to Avoid

- Choosing a name already trademarked or similar to another company

- Not filing Form INC-20A within 180 days

- Missing GST registration if applicable

- Ignoring mandatory filings, resulting in penalties

- Using residential address without proper NOC

How Long Does It Take to Register a Company in India?

On average, the company registration process takes about 7–10 working days, assuming all documents are in order. However, delays may happen due to:

- Incorrect documents

- Name rejection

- DSC/DIN issues

Can a Foreign National Register a Company in India?

Yes, foreign nationals can register a company in India. A minimum of one director must be a resident Indian (i.e., stays in India for at least 182 days in the preceding calendar year). Foreign investors can opt for:

- Private Limited Company

- Wholly Owned Subsidiary

- Joint Venture Company

- Liaison/Branch Office (through RBI route)

Online Company Registration in India: Is It Possible?

Absolutely. With the MCA’s simplified SPICe+ form, company registration is now fully online. You don’t need to visit any government office physically. All forms are digitally signed and submitted on the MCA portal.

Conclusion

Company registration is the foundation of building a credible, compliant, and scalable business in India. Whether you’re a startup founder, a solo entrepreneur, or an expanding enterprise, choosing the right company structure and registering it the right way ensures long-term success and legal protection.

Start your registration journey today with the right guidance and unlock new opportunities for your business.

FAQs on Company Registration

1. Is company registration mandatory in India?

If you want to run your business as a company or LLP, then yes. Sole proprietorships don’t require registration but lack legal protection and scalability.

2. Can I register a company on my own?

Yes. If you’re confident, you can do it through the MCA portal. However, many entrepreneurs prefer professional help to avoid errors. But the certification of a Chartered Accountant is also required therefore it would be good to go through a professional.

3. How do I check the availability of a company name?

Use the “Company Name Search” tool on the MCA website.

4. Do I need an office address to register a company?

Yes, a valid Indian address (residential or commercial) is required for the registered office.

5. Can I change my company name after registration?

Yes, by passing a special resolution and filing relevant forms with the RoC.

Want Help with Company Registration?

At Finance Cracker, we offer end-to-end services for private limited company registration, OPC, LLP, GST, and post-incorporation compliance—all at affordable pricing. Get in touch with our experts today!

Hey! If you also want to know the process of appointment of director then please click here