Table of Contents

What is option Contract?

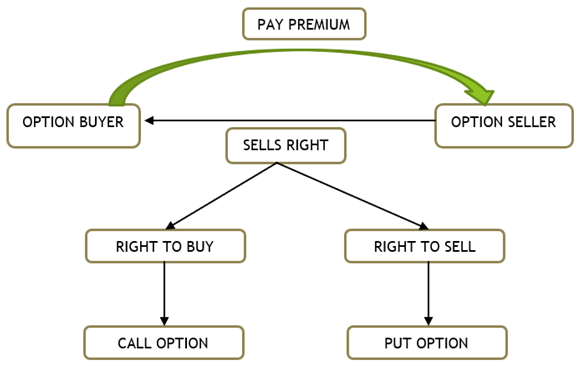

Option is a contract between two parties to buy or sell an underlying asset. This derivative contract provides buyer a right to buy or sell specified quantity of an underlying on or before a specific date at a specified price. In option contract, option buyer is not obligated or bound to exercise his right to buy or sell the underlying asset.

To obtain this right, buyer of option contract pays an amount to option seller or writer which is called premium or price of the option contract.

Important Terminology

Let’s understand some terminology –

Lot Size or Contract Size: –A standard exchange traded stock options come with a pre-defined contract size. The contract size or lot size is the number of units of the underlying asset that can be bought or sold in a contract. For example, if lot size for ICICI Bank share is 1300, then buyer of 1 call option will have right to buy 1300 share of ICICI Bank. Similarly, buyer of 1 put option will have right to sell 1300 share of ICICI Bank.

Strike Price: – The strike price means price at which option buyer or seller is ready to buy or sell the underlying assets. You can also say it contracted price.

Premium: – The fee that buyer of option contract pays for buying the right while entering into the contract.

Exercise: – Paying the strike price to receive asset.

Expiration Date: – The last date or maturity date upto which option contract must be exercised or otherwise it will become worthless.

Call Option

Call Option is a contract between two parties under which option buyer gets the right to buy the underlying or original asset (Stock, bond, index, commodity) at pre-determined price (Strike Price) within a specified period.

But do remember, option buyer gets here right and not an obligation. That means its upon him whether he wants to use his right or not.

For buying the right call option buyer will pay an amount to call option seller that is called premium.

The call option buyer will make profit if the price of the underlying asset will increase.

If the things not go well on or before the expiration date, that means price of the underlying asset falls below the strike price, the maximum loss a call option buyer will bear would be the premium amount.

Put Option

Put Option is a contract between two parties under which option buyer gets the right to sell the underlying or original asset (Stock, bond, index, commodity) at pre-determined price (Strike Price) within a specified period.

But do remember, option buyer gets here right and not an obligation. That means its upon him whether he wants to use his right or not.

For buying the right put option buyer will pay an amount to put option seller that is called premium.

The put option buyer will make profit if the price of the underlying asset will decrease.

If the things not go well on or before the expiration date, that means price of the underlying asset move above the strike price, the maximum loss a put option buyer will bear would be the premium amount.

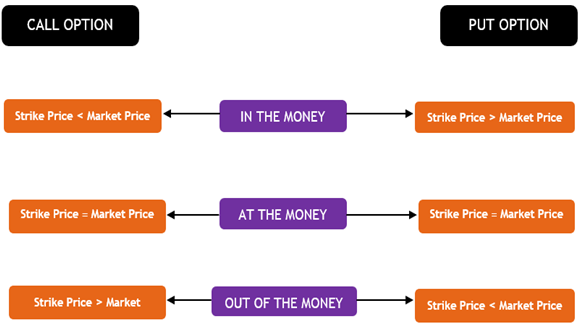

In The Money(ITM), Out Of The Money(OTM) And At The Money(ATM) Option

In the Money Option: – This term is used, to define positive payoff situation under an option contract. That means there would be a positive payoff if it is exercised immediately. Under call option if strike price less than market price of underlying and under put option if strike price is more than the market price of underlying asset, then under both condition it would be called that option is in the money.

Out of the Money: – This term is used, to define negative payoff situation under an option contract. That means there would be a negative payoff if it is exercised immediately. Under call option if strike price more than market price of underlying and under put option if strike price is less than the market price of underlying asset, then under both condition it would be called that option is out of the money.

At the Money: – Strike price equal to market price of the underlying asset.