Table of Contents

India has just witnessed the biggest reform in its Goods and Services Tax (GST) regime since its launch in 2017. On September 3, 2025, the GST Council, led by Finance Minister Nirmala Sitharaman, announced the GST Overhaul 2025, sweeping changes to simplify the tax system, cut rates on essential items, and introduce a new slab for luxury and “sin goods.”

This move, often dubbed GST 2.0, is expected to bring relief to households, reduce inflation, and boost consumption during the upcoming festive season. But not everything is cheaper—some products and industries will feel the pinch.

This bold step simplifies the tax system, lowers rates on essentials, and introduces a new slab for luxury and sin goods. For households, businesses, and policymakers, the GST Overhaul 2025 is a reset designed to cut inflation and boost festive-season consumption.

In this blog, we break down all the major changes, winners, losers, and what it means for India’s economy.

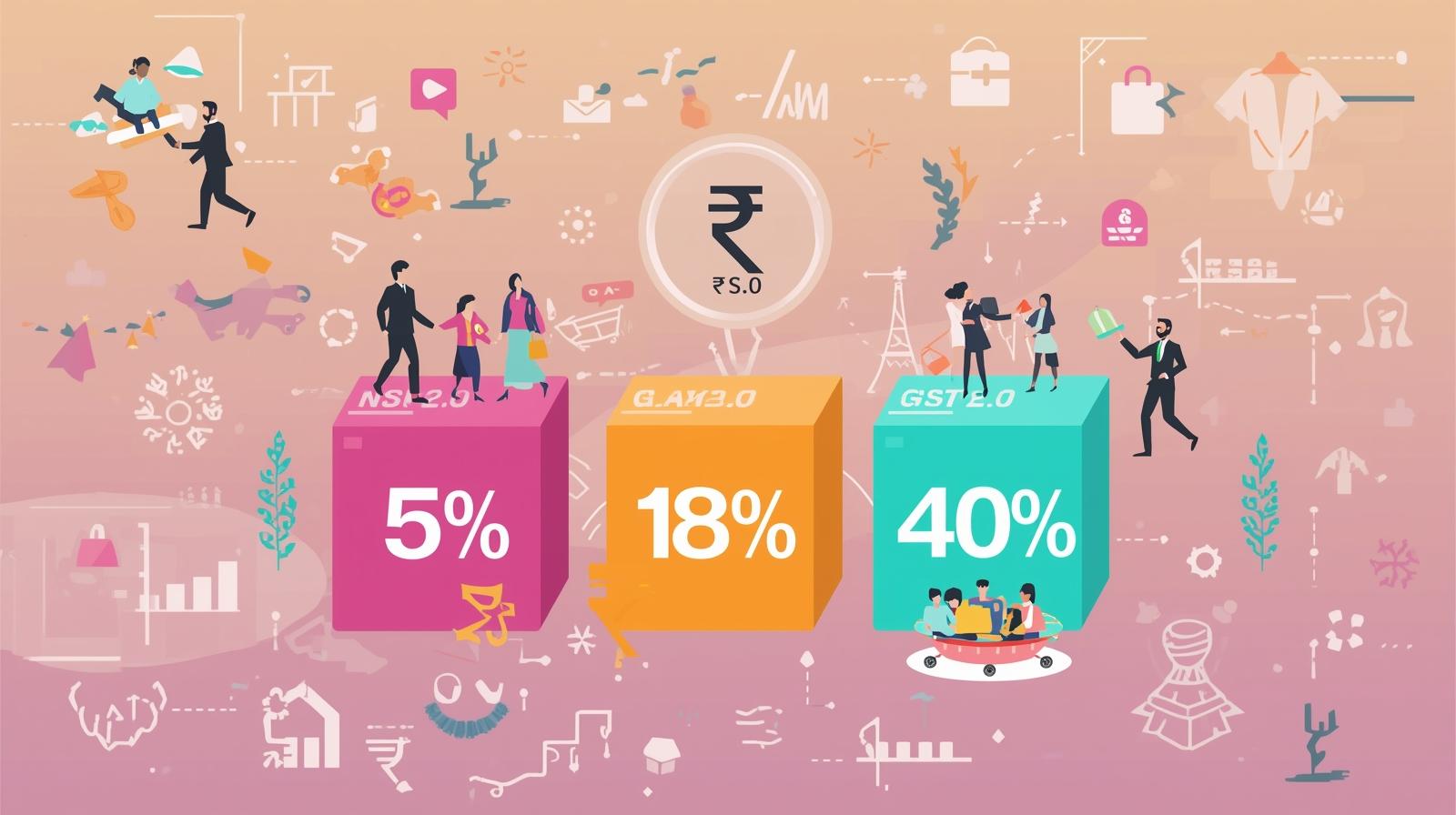

The Big Shift: New GST Structure

Earlier, India had a four-slab GST system—5%, 12%, 18%, and 28%—plus a separate cess for certain products. Now, that has been streamlined into just three slabs:

- 5% – Essentials and priority goods

- 18% – Standard goods and services, including many durables

- 40% – Luxury items, sin goods, and high-sugar beverages

👉 The GST Overhaul 2025 will be implemented from September 22, 2025, just before Navratri.

What Gets Cheaper After GST Overhaul 2025

Several rate cuts directly benefit middle-class families, farmers, and industries:

1. Everyday Essentials

- Toothpaste, soaps, shampoos, talcum powder

- Packaged food items and milk products

- Medicines and common FMCG goods

👉 All of these now attract just 5% GST instead of 12–18%.

2. Health and Insurance

- Life and health insurance premiums are now completely tax-free (0% GST).

- Life-saving drugs, cancer medication, and diagnostic instruments also moved to 5% or 0%.

3. Consumer Durables

- TVs, washing machines, refrigerators, air conditioners, dishwashers, cement, and passenger cars move from 28% to 18% GST, cutting prices by 8–10%.

4. Green Economy & Agriculture

- Electric vehicles (EVs) continue at just 5% GST, encouraging sustainable mobility.

- Tractors, agri-machinery, fertilisers, and pesticides are taxed at 5%, making farming inputs cheaper.

What Gets Costlier in GST Overhaul 2025

While many goods became affordable, a few categories saw hikes:

- Apparel above ₹2,500 → 18% GST (up from 12%).

- Coal → 18% GST (up from 5%), raising industrial energy costs.

- Soft drinks, sugary beverages, energy drinks → Now at a steep 40% GST, discouraging high-sugar consumption.

Economic Impact of GST Overhaul 2025

Economists say the GST Overhaul 2025 is more than a rate revision—it’s an economic strategy. The government estimates a revenue loss of ₹48,000 crore, but the benefits could outweigh it:

- Inflation relief: Consumer inflation may ease by 1 percentage point.

- Consumption boost: Lower taxes on durables and essentials will drive festive shopping.

- GDP growth: Economists expect a 1% jump in GDP growth over the next year.

- Stock market impact: FMCG, auto, insurance, and consumer durables companies are likely to gain.

Winners and Losers

| Winners | Losers |

|---|---|

| Middle-class households (cheaper FMCG, durables, insurance) | Soft drink makers, tobacco firms |

| Healthcare & insurance sector | Apparel brands in premium segment |

| Farmers & agri-industry | Coal producers and power plants |

| Automakers & appliance makers | Luxury and “sin goods” makers |

Final Thoughts

The GST Overhaul 2025 is a turning point for India’s indirect tax system. The GST Overhaul 2025 is more than a tax tweak—it’s a strategic reset to balance affordability with revenue, simplify compliance, and stimulate demand at a crucial time for India’s economy.

For households, this means a lighter monthly budget. For businesses, especially in consumer and auto sectors, it promises higher sales. And for the government, it’s a festive-season push to growth and stability.

As GST 2.0 rolls out, the coming months will reveal how effectively it boosts India’s economy.

If you want to know 10 Tips for the financial success in India click here