Table of Contents

Meaning of Money Market Hedge

Money market hedge is one of the tools of risk management related to foreign exchange risk. Under this, forex risk can be hedged using the money market. Money market consists of negotiable instruments such as treasury bills, commercial papers. and certificates of deposit.

This method involves locking the future inflow and outflow of the foreign currency now in the company’s domestic currency to mitigate the risk of exchange rate fluctuation.

The money market hedge is similar to a forward market hedge. Application of the money market hedge is more complicated as compare to forward market hedge. Therefore, a large company who have a lot of forex transaction will always prefer forward market hedge over the money market hedge.

Hedging in Case of Foreign Currency Receivable

Let’s learn how to hedge forex risk using the money market hedge.

Step-I (Transaction & Risk)

In Ist step we can see that there is a business man who exported goods to a foreign company. Now in this position the exporter will receive foreign currency for exporting goods after few days or month or as the case may be. Suppose, the time period is 3 months in above case.

Exchange rate at the time of transaction is 1$ = INR 75. Expected to receive $ 1,00,000 after 3 months.

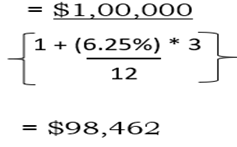

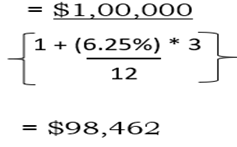

3 months interest rate for $: 6.12% – 6.25%

3 months interest rate for INR: 3.50% – 3.75%

In above case there is a concern for business man that after 3 months the exchange rate may fluctuate adversely that may cause huge loss to him. For example, if exchange rate after 3 months turns to 1$ = INR 70 then business man will receive only Rs. 70,00,000 ($1,00,000 * 70) as compare to Rs. 75,00,000 and he will bear loss of Rs. 5,00,000.

Therefore, to manage the risk of exchange rate fluctuation, the business man will use the money market hedge.

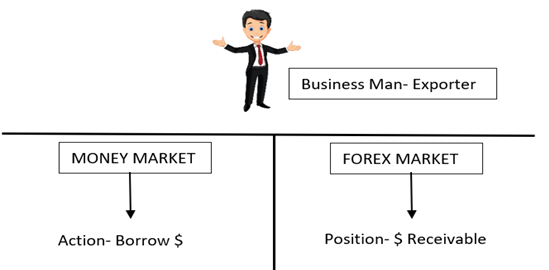

Step II (Using the Money Market Hedge to manage risk)

Let’s understand the second step very carefully. To manage the risk following steps to be taken by the exporter in the money market to hedge foreign currency-

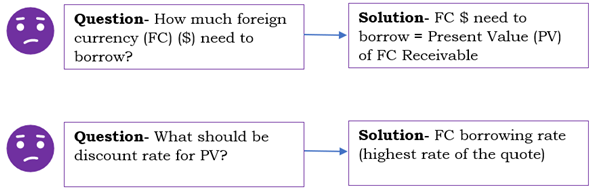

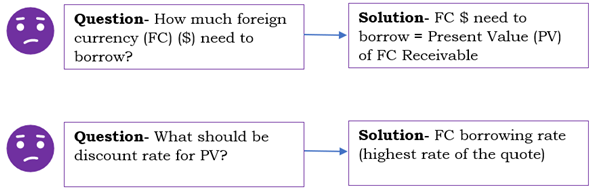

1- Borrow $ at the time zero, means at the time of transaction

2- In above case the exporter will borrow $ at time zero = Present Value of $ Receivable

3- Sell FC ($) raised through loan at spot rate at time zero = $98,462 * INR 75

= INR 73,84,650

4- At T=3 that means after 3 months repay the FC ($) loan with interest using the FC received.

Hedging in Case of Foreign Currency Payable

Let’s learn how to hedge forex risk using the money market hedge.

Step-I (Transaction & Risk)

In Ist step we can see that there is a business man who imported goods from a foreign company. Now in this position the importer will pay foreign currency for importing goods after few days or month or as the case may be. Suppose, the time period is 3 months in above case.

Exchange rate at the time of transaction is 1$ = INR 75. Expected to pay $ 1,00,000 after 3 months.

3 months interest rate for $: 6.12% – 6.25%

3 months interest rate for INR: 3.50% – 3.75%

In above case there is a concern for business man that after 3 months the exchange rate may fluctuate adversely that may cause huge loss to him. For example, if exchange rate after 3 months turns to 1$ = INR 80 then business man will pay Rs. 80,00,000 ($1,00,000 * 80) as compare to Rs. 75,00,000 and he will bear loss of Rs. 5,00,000.

Therefore, to manage the risk of exchange rate fluctuation, the business man will use the money market hedge.

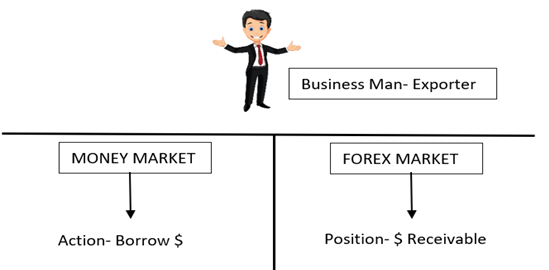

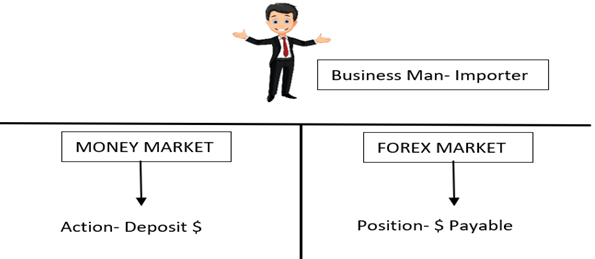

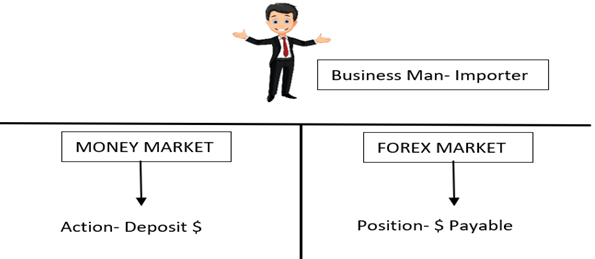

Step II (Using the Money Market Hedge to manage risk)

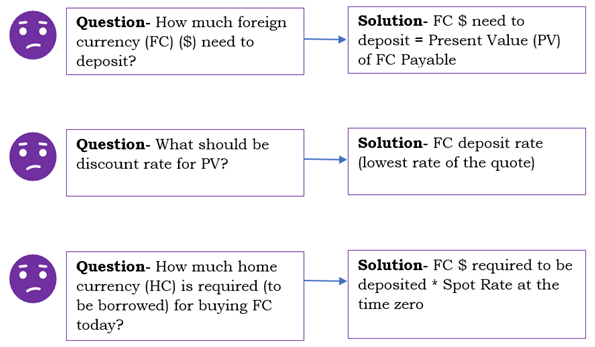

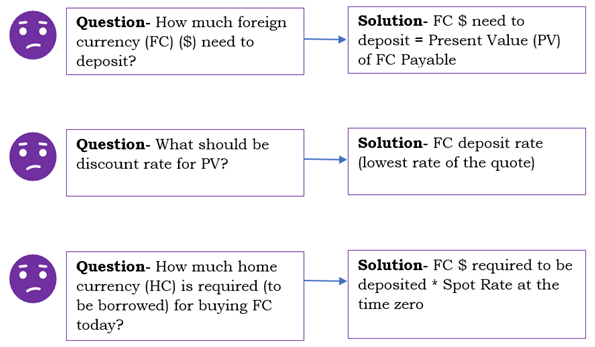

Let’s understand the second step very carefully. To manage the risk following steps to be taken by the importer in the money market to hedge foreign currency-

1- Deposit FC $ at the time zero, means at the time of transaction

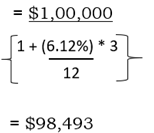

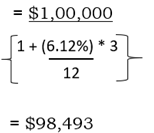

In above case the importer will deposit $ at time zero = Present Value of $ Payable

2- Home currency required to borrow for buying FC $ for deposit = $98,493 * INR 75

= INR 73,86,975

3- At T=3 that means after 3 months pay the FC ($) payable through the proceed of deposit of FC $. FC bought and deposited would be sufficient to settle FC payable at the maturity.