Exchange Margin is the amount that bank charge when you buy or sell foreign currency to the Bank. For better understanding of this concept you have to recall the concept of Inter-Bank Market and Retail Market.

An importer or exporter or any other person who buy or sell foreign currency to Bank, then this transaction called a retail transaction. But to fulfil the demand of an importer or exporter or any other person banks also do a parallel transaction in Inter-Bank Market to buy or sell the foreign currency.

It’s obvious that bank will not do any transaction for us for free. For providing such services they will charge some amount that is called Exchange Margin. In market no one is going to provide you free services and they will definitely charge some amount for their services. You have to keep this point in your mind for better understanding of this concept.

Now let’s start a new example after having the above funny example in our mind-

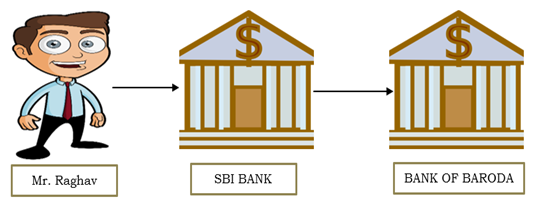

Scenario I- Mr. Raghav want to buy $ and he approaches SBI Bank for the same. As we have understood from the above funny example the bank is not going to provide the service for free, here SBI Bank will charge an amount for his service that is called Exchange Margin. Now SBI will approach to Bank of Baroda for buying $. Suppose exchange margin is 1%. SBI buys the $ from Bank of Baroda for Rs. 70. Now SBI will sell $ to Mr. Raghav after adding his exchange margin. It means SBI will sell $ at Rs. 70.70 to Mr. Raghav after adding exchange margin.

Scenario II- Mr. Raghav want to sell $ and he approaches SBI Bank for the same. As we have understood from the above funny example the bank is not going to provide the service for free, here SBI Bank will charge an amount for his service that is called Exchange Margin. Now SBI will approach to Bank of Baroda for selling $. Suppose exchange margin is 1%. SBI sells the $ to Bank of Baroda for Rs. 70. Now SBI will provide only Rs. 69.30 to Mr. Raghav after deducting his exchange margin.