Table of Contents

What is Call Option?

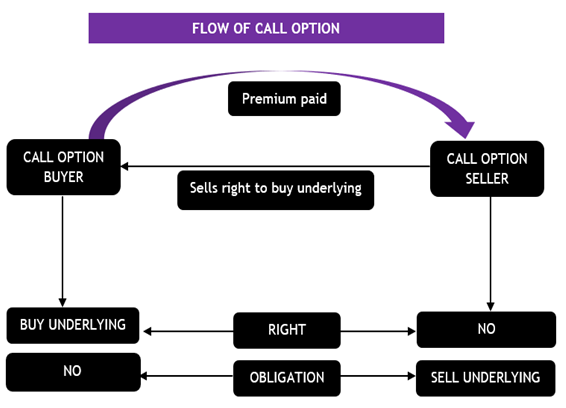

Call Option is a contract between two parties under which option buyer gets the right to buy the underlying or original asset (Stock, bond, index, commodity) at pre-determined price (Strike Price) within a specified period.

But do remember, option buyer gets here right and not an obligation. That means its upon him whether he wants to use his right or not.

For buying the right, call option buyer will pay an amount to call option seller that is called premium.

The call option buyer will make profit if the price of the underlying asset will increase.

If the things not go well on or before the expiration date, that means price of the underlying asset falls below the strike price, the maximum loss a call option buyer will bear would be the premium amount.

Payoff and Profit at The Expiry of Call Option Contract

Buyer’s Perspective

The call option buyer will exercise his right only if he is in profit that means he will exercise his right only when market price is more than strike price.

Call Option Buyer’s Payoff: – Market Price (Spot Price) – Strike Price

Profit/Loss for Call Option Buyer: – Market Price – Strike Price – Premium

Seller’s Perspective

Call Option Seller’s Payoff: – -Market Price (Spot Price) – Strike Price Profit/Loss for Call Option Seller: – -Market Price – Strike Price – Premium

Example

Share Price of HDFC Bank (Here share of HDFC Bank is an underlying asset) is currently trading at Rs. 800 per share. Mr. Tony is an investor and after observing the current market situation he come to a conclusion that the market price of will jump within the period of one month. He entered into call option contract to buy share of HDFC Bank at strike price of Rs. 810 per share at the expiry of one month. Mr. Tony paid Rs. 15 per share premium for buying the call option.

Case-I: – Market Price of HDFC Bank at the expiry of contract- Rs. 850 per share

Mr. Tony has bought a call option, therefore he has right to buy share at Rs. 810. At the expiry of the contract market price of the share is Rs. 850 per share. As Mr. Tony can get the share of HDFC Bank at a lower price as compare to market, he will exercise his right and, in this case, payoff would be Rs. 40 per share (850 – 810) and profit would be Rs. 25 per share ((Rs. 40 – Rs.15 (i.e. premium amount)).

| Why Mr. Tony exercised his right? Let’s understand this point with a normal life example. Suppose you are a buyer and you have entered into a contract to buy any product after 1 month at a price of Rs. 1000. Suppose after 1 month market price of that product is Rs. 1500. Then what you will do in this case? Yes, you will definitely buy that product for Rs. 1000 as per your contract and now as the market price of that product is Rs. 1500 you can sell that product in the market and earn profit of Rs. 500. |

Case II: – Market Price of HDFC Bank at the expiry of contract- Rs. 820 per share

Mr. Tony has right to buy share at Rs. 810. At the expiry of the contract market price of the share is Rs. 820 per share. As Mr. Tony can get the share of HDFC Bank at a lower price as compare to market, he will exercise his right and, in this case, payoff would be Rs. 10 per share (820 – 810) and loss would be Rs. 5 per share ((Rs. 10 – Rs.15 (i.e. premium amount)).

Case III: – Market Price of HDFC Bank at the expiry of contract- Rs. 810 per share or lower than 810

As in this case payoff would either be Zero or in negative, Mr. Tony will not exercise his right. Therefore, loss would be Rs. 15 per share i.e. premium amount.