Table of Contents

Meaning

Netting is an internal risk hedging tool to manage the forex risk. A company may have multiple forex exposure from different operations in the form of receivable or payable. By using this process the company can offset these exposures and can obtain the net exposure position. Then this net exposure can be hedged in the forex market.

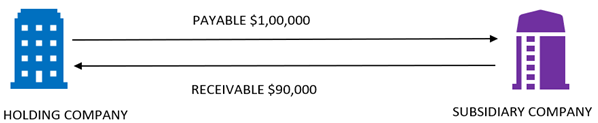

Suppose, there is a company that has exposure of $1,00,000 payable and $90,000 receivable, then after netting the net exposure of the company would be $10,000. This process will also reduce the cost of hedging.

Normally netting only occurs in one currency at a time that is USD against USD, YEN against YEN, etc. However, different currencies can also be matched against each other, if any such agreement is there. Netting can also be seen in trading. Suppose, as a trader, you placed a trade to buy 100 shares of a company and you have also sold the 90 shares of the same company then after netting your net exposure would be 10 shares.

Types of Netting

There are two types of netting the first one is Bilateral netting and the second one is Multilateral netting. Let’s understand both terms.

Bilateral Netting

As apparent from the name, Bilateral netting involves transactions between two parties. This can be between the parent company and a subsidiary company or between two subsidiaries.

In this case, the total flow of funds is $1,90,000. But in bilateral netting, the holding company will pay only $ 10,000. This will result in a saving in transaction costs. The balance amount can be hedged into the forex market.

Multi-lateral Netting

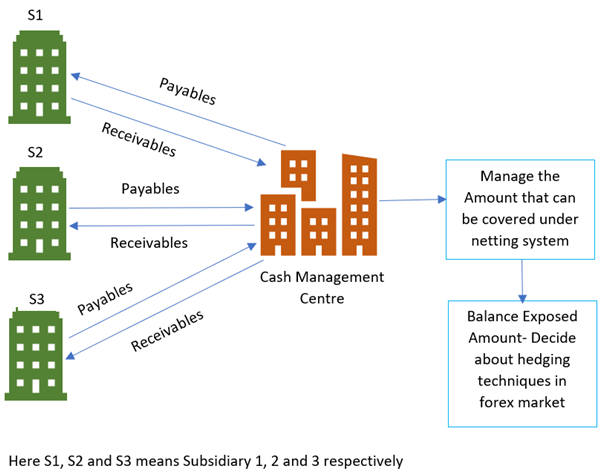

As apparent from the name, in multi-lateral netting, there would be the involvement of more than two parties. Multi-lateral netting is a payment arrangement among three or more parties. In this process transactions of various parties consolidated rather than settled individually.

Under this system, all the beneficiary parties send their invoices to a central treasury or netting center. The netting center is responsible for the settlement of funds. After getting all invoices netting center decides how much money each party is required to pay or receive. After the netting process, the parties who have negative cash flow will send, the money to the netting center, and then the netting center will send the payments to parties who have a positive fund balance.

Examples

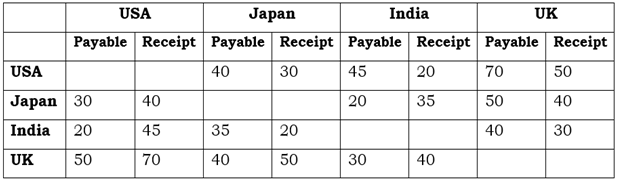

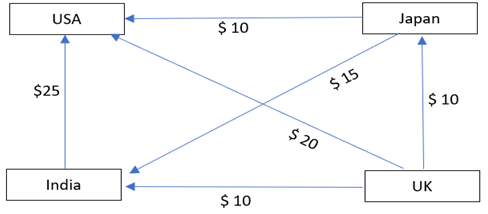

The following payments and receipts are to be settled among a parent company and its subsidiaries located in Japan, India and UK. All amounts are in $.

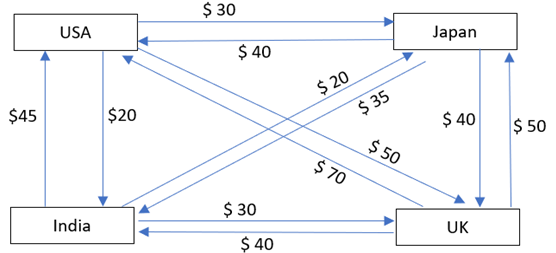

For better understanding let’s make a Cash Flow Diagram-

The above cash flow diagram is showing that, there are total 12 transactions. Now let’s see how netting will affect the above transactions.

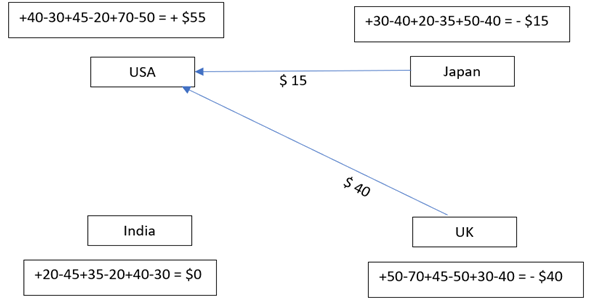

Method I- Bilateral Netting

On application of bilateral netting, the total number of remaining transactions is only 6.

In the above example, the USA head office is required to pay a subsidiary in Japan $ 30 and about to receive $ 40 from him. On application of bilateral netting, USA head office will receive $ 10. Similarly, we will apply bilateral netting in all transactions.

Method II- Multi-lateral Netting

On application of multi-lateral netting, the total number of remaining transactions is only 2.

In the above example, the USA parent company has positive cash flow, and Japan and UK subsidiaries have negative cash flow. Therefore, Japan and UK subsidiaries will pay $ 15 and $ 40 respectively to the USA parent company.

Great!!!…you did a good job and pictorial presentation of the concept helped me to understand the concept easily.

You made my job easier.