Table of Contents

What is Credit Card?

A credit card is a useful tool for managing your money in times of need. You may use it to get access to money, buy things, and then pay it back later. A credit card is an unsecured credit facility offered by banks (like HDFC Bank, ICICI Bank, Axis Bank etc) or non-bank financial institutions (NBFCs) based on the applicant’s income, credit score, and credit history.

You can make transactions up to the specified limit and pay them off on time or turn them into EMIs and spread the cost over a few months. Today, a credit card is one of the most highly competitive banking products. Banks are launching so many credit cards with different benefits and features every year.

Some important terms related to credit card

Interest

As we have discussed above, using a credit card is like borrowing money. When you use your credit card, it means you have borrowed money from the card-issuing bank. However, the bank will never charge interest if you pay your credit card bill before the due date.

Generally, banks provide an interest-free credit period of 45 to 50 days. If you have missed your due date for making payment on your credit card bill, then the bank will charge heavy interest on the outstanding amount. On credit cards, interest is charged monthly and not on an annual basis. Banks charge 3% to 5% monthly interest or around 36% to 60% annually. Therefore, it is advisable that you never miss a credit card bill payment.

Credit Limit

The credit limit is the maximum amount that you can borrow using your credit card. If you try to go beyond the limit, the bank will decline your transactions.

Billing Cycle

The billing cycle is the time period in which you can make purchases before you get billed. Generally, banks provide a period of 30 days for the billing cycle. Purchases made at the beginning of the billing cycle have a longer interest-free period to clear the dues. For example, the bank will generate a bill on June 30th for all of your purchases in June. The whole period of 30 days in June is your billing cycle.

Due Date

The due date is the period of time that banks provide to credit card holders to make the payment of outstanding dues from the date of billing. This time period may vary between 15 and 20 days. In the preceding example, if the bill for Rs. 75,000 is generated on June 30th, the bank may allow the cardholder to make payment by July 15th, the following month. In this example, the due date for payment is 15th July.

Minimum payment

This is the minimum amount set by the bank that you have to pay on each generation of a bill. If you do not pay this amount, you will have to pay heavy charges for it, apart from interest. Non-payment of the minimum amount will also negatively impact the credit score of the cardholder. By making a minimum payment, a cardholder can carry forward the balance amount for the next billing cycle, but the credit cardholder has to pay interest on this carried forward amount.

Credit Utilization Ratio

The credit utilization ratio is the proportion of the credit limit that has been used to the total amount of credit available. For instance, if your card has a credit limit of Rs. 1,00,000/- and you have utilized Rs. 45,000/- in a billing cycle. In this case, your credit utilization ratio would be 45%. The ideal ratio identified by the banking authorities is 30%. Higher credit utilization may raise questions about your financial stability.

Credit Score

A person’s creditworthiness, or capacity to pay back debt, is determined by their credit score. Typically, it is stated as a number based on the individual’s credit history and payback records across various loan types and credit institutions. Credit rating is an alternative term for credit score.

Joining Fee and Annual Fee

Joining Fee is the fee that the card issuer charged at the time of issuance of credit card. This is a one time fee that you have to pay on the approval of your credit card. There are some issuer who may waive off the joining fee.

Annual fee is the fee that the card issuer charge for services provided during a year. Some issuer may also waive off this fee on fulfillment of some conditions.

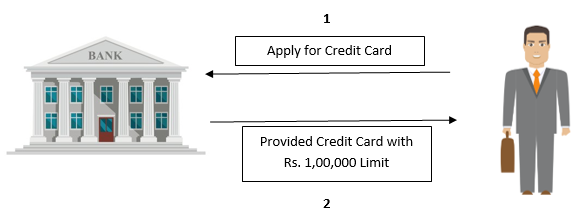

How does Credit Card work?

Every credit card comes with a credit limit. The credit limit is the maximum amount that you can use for your purchase using a credit card. When you use the card for your purchase, it means you are borrowing money from your card’s issuing bank, and you have to repay this amount within the specified time given by the bank. Let’s understand the process with an example- Suppose Mr. XYZ has a credit card with a credit limit of Rs. 1,00,000. He went to a shopping store and purchased a Mobile Phone for Rs. 35,999/-. He doesn’t have money to pay for the mobile. Therefore, he used his credit card to make the purchase.

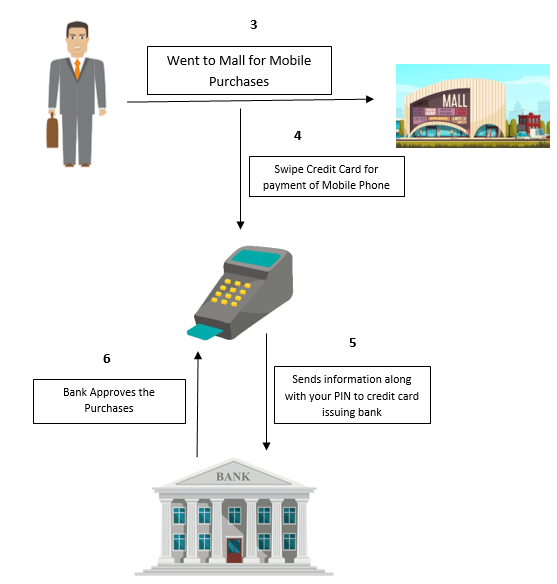

Step 1: Mr. XYZ purchased Mobile Phone of Rs. 35,999/-

Step 2: After making the purchase, the storekeeper will request payment.

Step 3: Mr. XYZ can pay with his credit card.

Step 4: When you swipe your card on the POS machine at the store, the POS machine will transfer the data to your credit card’s issuing bank for confirmation of payment.

Step 5: If you have entered your credit card PIN correctly, the bank will approve your payment.

Step 6: In this case, the bank paid the merchant on behalf of Mr. XYZ.

Step 7: At the end of the billing cycle, the bank will generate a credit card bill for Rs. 35,999/- and provide a time frame with a due date for payment.Step 8: Mr. XYZ has to make payment of the credit card bill before the due date.

Conclusion

Aside from the positive aspects of a credit card, there are numerous disadvantages. A credit card user must be aware of the various aspects of a credit card–

- Choose the right card that suits your lifestyle;

- Before applying for a credit card, make sure you understand the fees and charges associated with that card; click here to see sample fee and charges of a credit card.

- Make timely payments on your credit card bill. This will also help in building your credit score;

- Don’t think that credit card is free money. This thought process will result in the unnecessary expenditure

Do your want to download EMI Calculator ? , click here

Hello dear if you want know what is derivative?, then click here