Table of Contents

What is Interest Rate Parity?

Interest rate parity is a no-arbitrage condition. In simple word an investor will not be allowed to gain a riskless return by borrowing at lower rate in one country and investing at high rate in another country. According to this theory interest rate differential between two countries is approximately equal to percentage spread (Annualised premium or discount) between the currencies’ FR and SR. In this way Interest Rate Parity establish a link between forex and money market.

As per Interest Rate Parity, currency having lower interest rate will be at premium and currency having higher interest rate will always be at discount.

There are two assumption to interest parity, the first one is capital mobility and other one is perfect substitutability of domestic and foreign assets. If there is market equilibrium then return on domestic assets will be equal to exchange rate adjusted expected return on foreign assets.

There are two types of interest rate parity the first one is uncovered interest rate parity where there is always a risk of unanticipated change in exchange rate and the second one is covered interest parity where risk of unanticipated change in exchange rate is covered through forward contract.

Formula

The Interest Rate Parity principle is used to determine theoretical forward rate and the formula is under-

Example

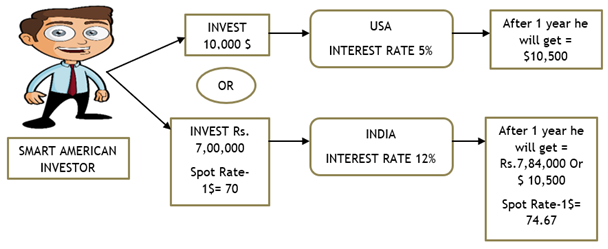

Now let’s take an example for better understanding. Do you know an another meaning of ‘Parity’ is ‘Equality’? According to Interest Rate Parity theory, if you are thinking that another country has higher interest rate then it will help you to make big money then you are wrong. You will get the same return as you would have get even if you are investing the same amount in your own country which has lower rate of interest.

In the above example you can see that smart American Investor, that investor has $10,000 and he has two option to invest, either he can invest in USA @ 5% OR he can invest in India @12%. What do you think what he should do? Whether he will go for to earn 5% or @12%. Look he is a smart investor he knows all about the Interest Rate Parity theory. He knows in both the cases after one year he will get $10,500.

This theory establishes a connection between money market and forex market. Have you seen in above example how spot rate adjusted itself? It’s clear if Interest Rate Parity is valid then you will not be able to take benefit of interest differential. But if Interest Rate Parity is not valid then in that case there would be an opportunity of arbitrage.

Let’s calculate in above example % change in currency rate-

(74.67-70)/70*100 = 6.67% (Premium)

Interest differential = 12% – 5% = 7%

Now here we have also proved in above example that interest differential of two currencies is approximately equal to % of spread between future/ forward rate and spot rate.

If you also want to know about Purchasing Power Parity then click here