Table of Contents

MEANING

Net Asset Value (NAV) is the value of a unit of a mutual fund. It is a price at which an investor can buy or redeem the units of mutual funds. In other words, we can say that it represents per unit market price of a mutual fund unit.

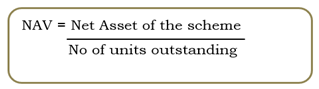

It is derived by dividing the market value of total asset of the fund, less total liabilities attributable to those assets, by the numbers of units outstanding.

NAV changes every day. As we know mutual funds are trust that pool money of investors and invest them in various securities like stock, bond, gold etc. Value of these assets changes every time. NAV is calculated on closing of each trading day based on the market prices of securities under portfolio.

VALUATION RULE FOR ASSETS UNDER PORTFOLIO

| Asset | Valuation Rule |

| Liquid Assets (Asset instantly convertible into cash) | As per books |

| All listed and traded securities | Closing Market Price |

| Debentures and Bonds | Closing price or yield |

| Illiquid shares or debentures | Last available price or book value whichever is lower. Estimated Market Price approach to be adopted if suitable benchmark is available. |

| Fixed Income Securities | Current Yield |

COMPUTATION OF NAV

NAV is calculated by dividing the net asset of the fund by number of units outstanding.

Net Asset of the scheme = Market Value of securities under investment + Receivables (Dividend and Interest) + Other Accrued Income + other owned assets – Accrued Expenses – Liabilities toward unpaid assets – Other Liabilities

For example, let’s say market value of securities under investment is Rs. 100 lakhs, liabilities are amounted to Rs. 40 lakhs and no. of outstanding units are 10 lakhs. Then NAV for scheme would be Rs. 6 per unit [(100 – 40)/10].

WHETHER INVESTMENT DECISION SHOULD BE BASED ON NAV?

My answer is no. Your investment decision should never be based on NAV of a mutual fund. Suppose if there are two fund one of them have NAV of Rs. 100 per unit and other one has NAV of Rs. 60 per unit. Then in this case you can’t say that the fund with higher NAV is good for investment.

Before investment in any fund we must look the past performance of the fund. Funds with lower NAV can perform better than the funds with higher NAV.

Before investing in a fund, we must also see the invested asset of the firm. Sector of the investment and potential of those sectors must also be analysed.

MARKET VALUE OF A SHARE VS VALUE OF A MUTUAL FUND

Pricing system of mutual fund units and market value of stocks listed on stock exchanges are totally different.

Market value of shares are driven by demand and supply in the market. The price of a stock is totally dependent on market demand. Market value of share also indicates the performance of the company.

Whereas NAV is the value of fund invested less cost to run the fund. NAV is not a performance indicator of a mutual fund.

CUT OFF TIMING FOR INVESTMENT IN MUTUAL FUND

All mutual fund investments have a cut-off time. Cut-off time determines of which date NAV will be applicable for your investment.

Suppose you have made a investment in a mutual fund unit after the cut-off time then you will not be eligible for NAV of the same day and therefore next days NAV will be applicable for your investment.

SEBI as a regulator, regulate the cut-off time for mutual funds.

Normal cut-off time for liquid and overnight fund was 1.30 pm and for other funds it was 3.00 pm. Other funds include equity, bonds and hybrid funds.

Due Corona Pandemic and nation-wide lock-down, the SEBI has revised the cut-off timing.