Table of Contents

MEANING

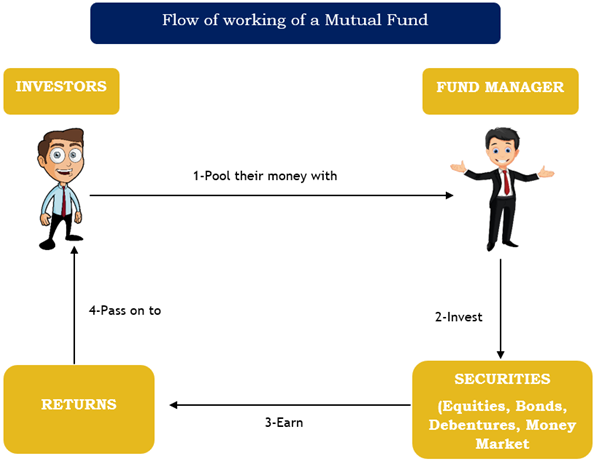

Mutual Funds are trust that pools money from a number of investors who share a common financial goal and invests the same in equities, bonds, money market instruments and/or other securities. Mutual funds are the most suitable investment for the cautious investor as it offers an opportunity to invest in a diversified professionally managed basket of securities at a relatively low cost.

For investment in Mutual Funds you don’t need a profession skill. A common man can invest in mutual funds and rest assured for his money because whatever he will invest in mutual funds will be manged by professional fund managers. In return for managing funds, fund manager charges some fees. There are so many schemes in mutual funds according to goal of investors and their risk appetite.

For managing funds of investors mutual funds charge fee called expense ratio.

CLASSIFICATION OF MUTUAL FUNDS

BASED ON STRUCTURE

Open Ended: – Under this scheme as an investor you don’t need to bother about the entry or exit. An investor can enter or invest at any point of time and can redeem the units or exit the scheme at his will. This does not come with any fixed maturity terms.

This fund provides liquidity and flexibility at the same time.

Close Ended: – In this scheme investor can invest only at the time of Initial Public Offer (IPO) or after listing in stock exchange. This scheme comes with a limited period of time. The investor can make his exit from the scheme by selling in the stock market, or at the expiry of the scheme or during repurchase period at his option.

Interval Scheme: – This scheme is a combo of Open Ended and Close Ended funds. Investors are allowed to invest in this fund only at specified intervals of time like monthly, quarterly or annually etc. Like open ended fund this fund also not have any defined maturity period.

BASED ON PORTFOLIO

Based on portfolio mutual can be classified as follows-

Equity or Growth Funds: – Equity funds are primarily invested in equity shares of the different companies. The main objective of these funds is capital appreciation in a long-term period of time. Having high risk as compare to other funds, these funds provide high returns over a long period of time.

Equity funds can be diversified into following categories-

- Flexicap/Multicap Fund- These funds invest in companies based on their market capitalisation. Based on market capitalisation there are three types of companies which are Large Cap, Midcap and Small Cap.

- Index Funds- Every stock market has a stock index which measures the upward and downward sentiment of the stock market. In India there are two stock index Nifty and Sensex. They mainly invest in securities in proportion of the Index. Like in Nifty 50 if Reliance Industries has 20% weight then they will also invest 20% of their portfolio in Reliance Industries.

- Contra Fund- Investors who invest in contra funds have an aggressive risk appetite. Contrarian investment involves invest in neglected stocks those have strong fundamental attributes and focusing on sectors those have high potential to grow.

- Dividend yield fund- These funds invest in shares of the companies having high dividend yield. Dividend yield schemes are of two types. First one dividend payout option under which dividends are paid out to the unit holders and NAV of units falls to the extent of dividend paid out. Second one is Dividend Re-investment option under which dividends are reinvested in scheme at ex-dividend NAV.

- Equity Linked Tax Saving Scheme (ELSS): – This kind of funds helps the investors in saving their taxes. Tax Saver Funds come with a 3 years lock-in period. Investment under this scheme is eligible for deduction u/s 80C of Income Tax Act, 1961.

Debt Funds: – This kind of funds help in getting fixed income at a reasonable risk. Funds are mostly invested in corporate bonds and government securities. Debt funds provide are less risky as compare to equity funds.

Balanced Funds: – As appearing from the name, this kind of mutual funds invest in both equity and debt. This kind of funds are suitable for those investors who are looking for moderate return by taking comparatively low risk.

SOME OTHER FUNDS

Gilt Funds- They are mainly invested in government securities.

International Funds- They raise money in India and invest the same in securities, bonds and other assets globally.

Sector Funds- They invest their entire fund in a particular sector like real estate, technology, auto, banking etc.

Money Market Funds- These funds are pre-dominantly debt-oriented schemes. These funds invest in safer short-term instruments like commercial paper, treasury bills, Govt-securities etc. These funds give a reasonable return to investors over a short period of time. These funds are suitable for investors with a low risk appetite.

Arbitrage Funds: – Arbitrage funds are those mutual funds which purchases stock in the cash market (i.e. purchase at spot price or current price of a stock) and simultaneously sell in the futures market. However, the margin between stock prices and futures prices are low. Therefore, arbitrage mutual funds undertake large number of trades to make substantial profit on the difference between cash and futures price.