Table of Contents

What is Purchasing Power Parity?

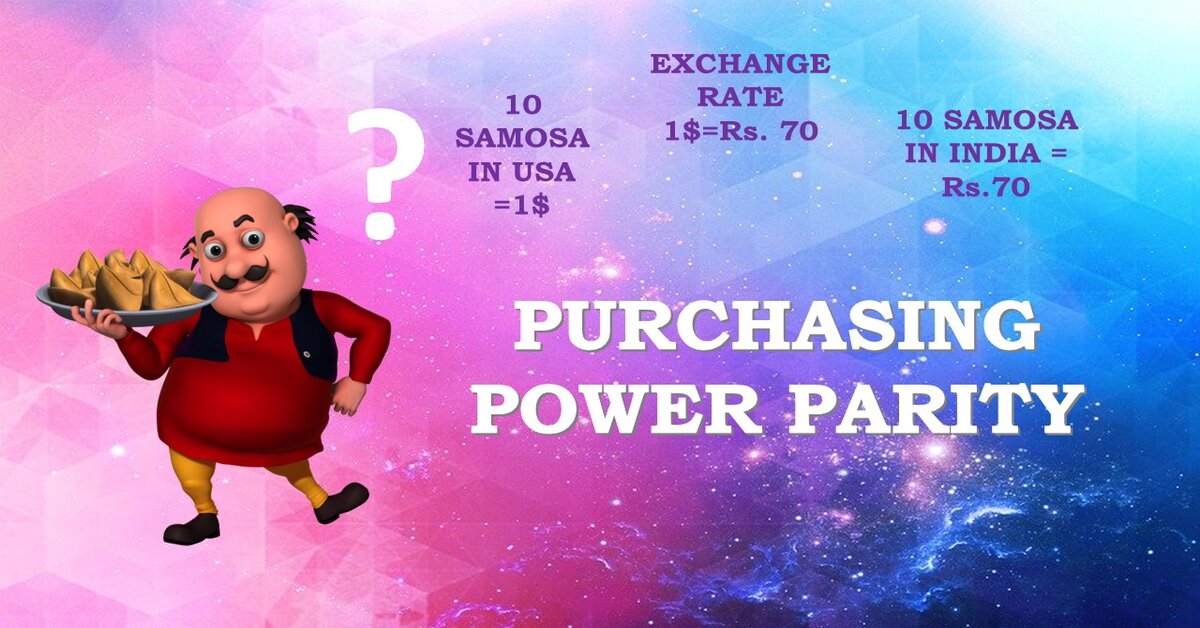

The Purchasing Power Parity (PPP) theory connects forex market to commodity market. According to this theory exchange rate between two currencies of two country depends upon purchasing power to buy same basket of goods in both countries. In simple word exchange rate should indicate the differences in prices of the same basket of goods in two countries. For example, if in US the price of 1kg apple is 1$ and in India price of 1kg apple is ₹ 70 then exchange rate should be 1$ = ₹70.

Can you relate this theory with Interest Rate Parity Theory? Oh! Here we go …. As per Interest Rate Parity if you invest some amount in your country then you will get the same return if you invest that amount in other country with high interest rates. Similarly, in Purchasing Power Parity if there is a product which is marketable in two countries then price of the product would be same for you either you buy that product in your home currency or foreign currency. That means your purchasing power would be equal in both the cases.

There are two types of PPP, the first one is absolute PPP and other one is relative PPP.

The absolute PPP is similar to law of one price, where in the absence of transaction cost, transportation cost, inflation, competitive pricing, government regulation other similar factors the prices of similar goods will have to be same in different countries if the prices are expressed in same currency after conversion.

In Relative PPP exchange rate is adjusted towards the inflation rate in different countries. By considering inflation rate relative PPP reduce some market imperfection as was in case of absolute Purchasing Power Parity.

Relative PPP is springs from absolute Purchasing Power Parity. For validity of Relative Purchasing Power Parity, validity of absolute Purchasing Power Parity is not necessary that means if absolute Purchasing Power Parity stand valid it means relative Purchasing Power Parity is also valid but it is not true in reverse case that means if relative Purchasing Power Parity stand valid that doesn’t mean that absolute Purchasing Power Parity is also stand valid.

Formula

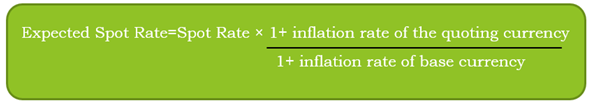

Formula as per relative PPP theory for expected spot rate=

Let’s just take examples for better understanding-

Example 1

Commodity Market Foreign Exchange Market

Price of a Pizza Rate of Exchange

India – Rs. 210 1$ = 72

USA – $ 3

Here in above example if apply the Purchasing Power Parity theory then the exchange rate between two currencies should be 1$ = Rs. 70 (210/3), but the quoted exchange rate is 1$ = 72 which indicates that in present scenario Purchasing Power Parity theory is not valid and therefore, there is a chance for an arbitrage.

In the above example we can also say that the US currency $ is overvalued in forex market.

Example 2

The rate of inflation in USA is likely to be 3% per annum and in India it is likely to be 6.5%. The current spot rate of US $ in India is Rs. 70. Find the expected rate of US$ in India after 1 year.

Ans: –

Expected Spot Rate = Spot Rate * ((1 + inflation rate of quoting currency)/ (1 + Inflation rate of base currency))

= 70 * (1 + .065)/ (1 + .03)

= Rs. 72.38

After 1 year expected Spot Rate would be- 1$ = 72.38