What is International Fisher Effect Theory ?

International Fisher Effect theory is combo of two theories, fisher effect and relative Purchasing Power Parity. According to this theory exchange rate differential between two countries over period of time would be approximately equal to difference between their countries’ nominal interest rate. In other words, if real interest rate is constant all over the world then differences between nominal interest rate of two countries will affect the expected change in spot exchange rate between two countries.

According to this theory spot rate is expected to change in equal proportion to nominal interest rate but in opposite side. If real interest rate is constant, the country which has higher nominal interest rate is experiencing higher inflation and accordingly the currency of that country is expected to depreciate against the currency of the country which has lower nominal interest rate.

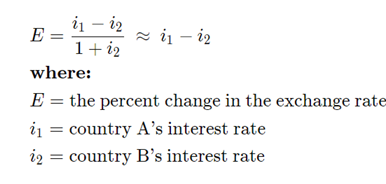

Formula for International Fisher Effect

Example

Ok… Now it’s example time for better understanding of above two part of this theory.

Current exchange rate – 1$ = Rs. 60

Exchange Rate after a year – 1$ = Rs. 63

Interest Rate India – 8%

Interest Rate in USA – 3%

Let’s apply International Fisher Effect-

% Change in Exchange Rate = Interest Rate Differential

(63 – 60)/ 60 *100 = 8% – 3%

5% = 5%

In above example we can see that there is a change of 5% in exchange rate of over a period of one year which is offset by the difference between interest rate of two countries.

As per International Fisher Effect, the currency which has higher nominal interest rate would depreciate against the currency which has lower interest rate because the country having higher interest rate would experience the higher inflation.

In above example we can see that India has higher nominal interest rate that’s why it’s depreciated against $ by Rs. 3 (63 – 60).

Ok, then what this term is ‘depreciated’?

Here depreciation means the purchasing power of the Rupee is decreased. At the day one you can buy a $ by paying Rs. 60 but after 1 year you have to pay Rs. 63 to buy a $.

Here Rupee is depreciated that means $ is appreciated.

Example

Current Spot Rate – 1$ = 70

Spot Rate after 3 months- 1$ = 69 In above example you will say $ is depreciated against the Rupee because on the day one you have to pay Rs. 70 but after 3 months you can buy a $ only for Rs. 69.