Table of Contents

Overview

Hello friends welcome to Finance Cracker. Saving Account is an account where we keep our hard-earned money that is not required immediately. The world is changing very fast. Banks are trying to adopt best technology to make their customer experience better.

Banking sector in India drastically changed in last one decade. Technology has changed Indian banking sector. Now a customer can do almost every banking related activity through a single mobile app.

Its obvious that customer will go for that bank which will provide better apps and ease his banking experience.

As a customer what we expect from our saving account? We want better mobile banking app, internet banking, good interest rate on our fund and last but not least zero balance saving account.

I have done some research and I have picked up 3 best banks which are technologically advanced.

During research my focus was totally on technology. I have not advanced my focus to minimum balance maintain.

If you want to know about best banks offering zero balance account then leave a comment, I will write an article on that one also.

Best 2 Banks for Saving Account

Ok! Let’s discuss about 2 best banks where you should open your saving account.

ICICI Bank

ICICI Bank is the second largest private bank after HDFC Bank. ICICI Bank rely more on technology as compare to other banks. No other bank provides ease and better user experience as compare to ICICI Bank.

ICICI Bank provides different type of saving account which are as follows-

1. Insta Save Account

As it appeared from its name, this account can be open within 4 minutes instantly. You will enjoy unmatched online banking experience 24*7 and access to wide network of branches and ATMs of ICICI Bank.

You don’t need to go branch for opening this account. You can open it from your home without paper work.

There are 3 types of Insta Save Account-

Insta Save Account (Normal) – This account has following features-

- Convenience of opening account online in a few minutes without paper work from the comfort of your home.

- Full access to ICICI Bank net banking and mobile banking tools like iMobile App and others

- Exclusive offers across groceries, medicine, entertainment and much more

- Banking services using whatsApp

- Average Monthly Balance Required – Rs. 10,000

- Get a Platinum Visa Debit Card and earn reward points

- Complimentary ₹50,000 Air Accident Insurance and ₹50,000 Purchase Protection Insurance.

Insta Save FD Account – This account has following features-

- Convenience of opening account online in a few minutes without paper work from the comfort of your home.

- Required opening of Fixed Deposit (FD) of Rs. 10,000

- Zero balance saving account that means you don’t need to maintain any minimum balance

- Get assured Credit Card linked to your FD with no income documents

- Full access to ICICI Bank net banking and mobile banking tools like iMobile App and others

- Exclusive offers across groceries, medicine, entertainment and much more

- Banking services using whatsApp

- Get a Platinum Visa Debit Card and earn reward points

- Complimentary ₹50,000 Air Accident Insurance and ₹50,000 Purchase Protection Insurance.

Insta Save Salary Account – This account has following features-

- Open your salary account instantly using Aadhar

- Get your salary credited and enjoy the benefits of no minimum balance commitment

- You will enjoy unmatched online banking experience 24*7 and access to wide network of branches and ATMs of ICICI Bank

- Get personal accident insurance of Rs. 5 lakhs and Air accident insurance of Rs. 30 lakhs

- Get a complementary debit card with purchase protection upto Rs. 1 lakhs

2. The ONE Saving Account

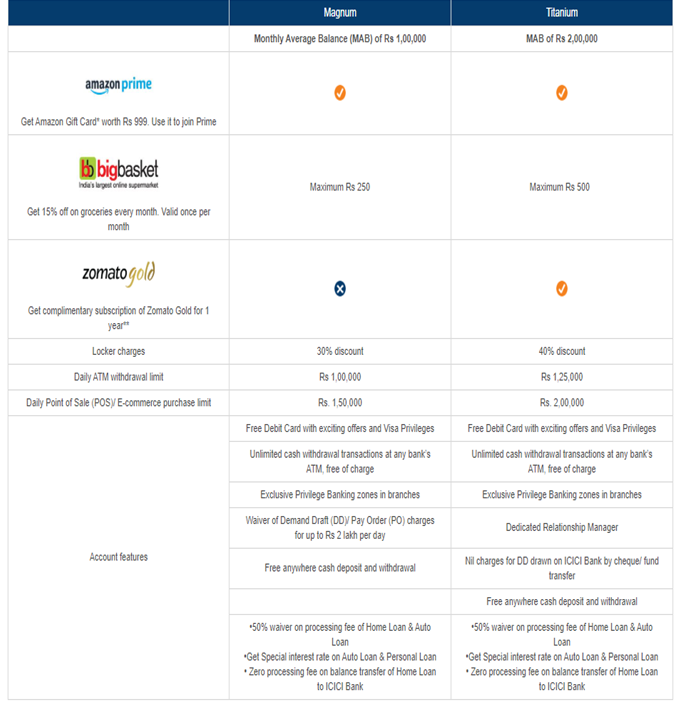

This is a premium account of ICICI Bank. This account will help you upgrade your lifestyle and achieve your financial goals. Following are the benefits-

- Benefits on home loans and brokerage waiver up to ₹22,500 for equity investments

- Specially designed Life Insurance and Health Insurance offerings

- Get premium subscription services such as Amazon Prime and Zomato Gold

- Exclusive offers at Bigbasket and SRL Diagnostics worth over ₹8000

- Unlimited free ATM transactions and up to 40% discount on locker rentals.

Variant of The ONE Saving Account

3. NPS Plus Saving Account

As it appeared from its name, this account comes with NPS Scheme. This account will help you in planning of your retirement. Currently ICICI Bank is providing some exclusive offers for this account.

There are three variant of this account which are as follows-

NPS Plus Gold Saving Account

Eligibility criteria:

- The account is available for Resident Individual (sole account between 18 years and 60 years.

- Account Opening Cheque (AOC) of ₹50,000 is required or a net salary credit of ₹50,000.

Minimum Monthly Average Balance (MAB): Nil, provided the total contribution to any or all of the below mentioned product/s should be minimum amount of ₹3,000 per month.

Mandatory product: National Pension System (NPS): Minimum amount of ₹1,000 per month.

Optional products:

- Recurring Deposit (RD): Minimum amount of ₹500 per month.

- Public Provident Fund (PPF) Account: Minimum amount of ₹500 per month.

Standing Instruction should be set for minimum 1 year for above products.

Features: To know about features of this account click here

NPS Plus – AURA Titanium Savings Account

Eligibility criteria:

- Resident Indian working woman from 18 years till 59 years should be the primary applicant.

- Account Opening Cheque (AOC) of ₹1 lakh is required or a net salary credit of ₹1 lakh.

Minimum Monthly Average Balance (MAB): Nil, provided the total contribution to any or all of the below mentioned product/s should be minimum amount of ₹10,000 per month.

Mandatory product: National Pension System (NPS): Minimum amount of ₹1,000 per month.

Optional products:

- Recurring Deposit (RD): Minimum amount of ₹500 per month.

- Public Provident Fund (PPF) Account: Minimum amount of ₹500 per month and maximum of ₹12,500 per month.

Standing Instruction should be set for minimum 1 year for above products.

Features: To know about features of this account click here

NPS Plus – The One Titanium Savings Account

Eligibility criteria:

- Resident Indian male between 18 years till 59 years.

- Account opening cheque (AOC) of ₹1 lakh is required or a net salary credit of ₹1 lakh.

Minimum Monthly Average Balance (MAB): Nil, provided the total contribution to any or all of the below products should be minimum amount of ₹10,000 per month.

Mandatory product: National Pension System (NPS): Minimum amount of ₹1,000 per month.

Optional products:

- Recurring Deposit (RD): Minimum amount of ₹500 per month.

- Public Provident Fund (PPF) Account: Minimum amount of ₹500 per month and maximum of ₹12,500 per month.

Standing Instruction should be set for minimum 1 year for above products.

Features: To know about features of this account click here

4. Regular Savings Account

This savings Account is available for Resident Individual (sole or joint account), Foreign national and Hindu Undivided Family (HUF) customers, who are above 18 years Customers below 18 years, can open a Young Stars Savings Account and customers above 60 years can open a seniors Club Savings Account.

Features:

Minimum monthly average balance (MAB):

- Metro and Urban locations – Rs.10,000

- Semi-urban locations – Rs.5,000

- Rural locations – Rs.2,000

- Gramin locations – Rs.1,000

Get complimentary personal accident insurance protection and purchase protection cover on your Savings Account.

Debit Card benefits:

- Use your Silver Debit Card to withdraw cash from any ATM. Use it online or at any Visa/Mastercard machine for shopping

- Daily cash and withdrawal limit as per your account variant. To know more.

Maximise your returns

Money multiplier: Earn higher interest by setting a balance limit above which money in the Savings Account will get converted into Fixed Deposit on request.

Convenient Banking

You can now manage your Savings Account from anywhere, anytime using Internet Banking, iMobile app and ATMs

Free e-mail statements.

5. Other Saving Accounts

- Silver Savings Account

- Gold Saving Account

- Titanium Savings Account

- Auto Assure Savings Account

- Home Assure Savings Account

- Investment & Tax Savings Account

- Savings Family Banking

- 3 in 1 Savings Account

- Gold Plus Savings Account

- HUF – Hindu Undivided family

KOTAK MAHINDRA BANK

Kotak Mahindra Bank is another tech giant in private sector bank. They also have good and awesome looking mobile banking app.

Kotak Mahindra Bank provides following types of Saving Bank Account-

1. 811 Saving Bank Account

811 is a full-service digital Bank account given to you within the convenience of the app. This is zero balance saving account. This account gives you the flexibility to spend, earn up to 4%* interest p.a., and they also provide some exclusive offers.

You can open Kotak 811 account by downloading the Kotak mobile banking app or just click here and open account instantly.

Features

Instant Account Opening

No visiting any bank branch or leaving your home. Just open your Kotak 811 account on smartphone or through a browser in an instant and quickly log in to the world of seamless digital banking.

No minimum balance commitment

Worried about paying charges for low balance in your account? Now enjoy no minimum balance commitment on your Kotak 811 bank account and experience true financial freedom.

Up to 4%* Interest Rate per annum

Earn up to 4%* interest annually on your account balance and let your bank account earn more money while you work or play!

ActivMoney## Auto Sweep in Facility

Want to earn higher interest of a fixed deposit (FD)? Set your sweep-in and sweep-out limit and see your funds being converted into an FD immediately.

- Avail higher interest rate through funds converted into Fixed Deposit.

- Eliminate the need to track your funds regularly and give instructions to the Bank for Fixed Deposit creation

- Greater flexibility and liquidity as the funds flow back into your savings account when required

Banking solutions at a single touch

You can open your investment account or book TD /RD in a single click from 811 Mobile banking app. You can also request for Chequebook, transfer funds or walk into a branch for cash transactions and enjoy many more benefits of a savings account.

Virtual Debit Card

The Debit Card is no more plastic with 811. It’s a Virtual Debit Card, shrunk to fit in your mobile. Check the card details within the safety of your app and use it to make online payments like Shopping, paying bills or recharging mobile / DTH, in few taps.

2. Edge Savings Account

With the Edge Savings Account, you can enjoy the best of regular, as well as privileged services, to give you a truly memorable banking experience. So, enjoy free access to all domestic VISA ATMs, or carry out NEFT transaction from your phone, all with one savings account.

Features

Monthly Balance: Average monthly balance of Rs. 10,000

Attractive Interest Rates upto 4%

Free access to all domestic VISA ATMs. Get upto 5 transactions per month and free cash withdrawal at Kotak Bank’s ATMs.

Convert savings account balance above a certain amount into Term Deposits with Kotak ActivMoney.

Classic Debit Card

3. Sanman Savings Account

The Sanman Savings Account is designed for you to enjoy faster and secure access to all your banking needs with low maintenance fees. Not just that, you also get free access to all domestic Visa ATMs, transfer funds, NEFT and a lot more.

Features

Monthly Balance: Average monthly balance of Rs. 2,000

Attractive Interest Rates upto 4%

Free access to all domestic VISA ATMs. Get upto 5 transactions per month and free cash withdrawal at Kotak Bank’s ATMs.

Rupay Debit Card

4. Junior Savings Account

The Kotak Mahindra Bank Junior Account is specifically designed to teach your children the benefits of saving, while also providing a host of privileges across dining, edutainment and shopping on kids’ brands.

Features

Attractive Interest Rates upto 4%

Get a personalised debit card for your child with your junior savings account

Avail NMC waiver and zero balance benefit

Enjoy exclusive account and offers on across brands for kids

5. Other Savings Account

- Pro Savings Account

- Classic Savings Account

- Silk Women’s Saving Account

- Ace Savings Account

- Grand Savings Account

- Nova Savings Account

- My Family Savings Account

- Alpha Savings Account

Interest Rates on Saving Bank Accounts

ICICI Bank

Interest is calculated on a daily basis on the daily closing balance in the Account, at the rate specified by ICICI Bank in accordance with Reserve Bank of India directives. The interest amount calculated is rounded off to the nearest rupee. With effect from March 30, 2016, interest will be paid quarterly in March, June, September and December.

With effect from 4th June 2020, the savings account interest rate applicable would be:

3.00% for end of day account balance of below ₹50 Lacs

3.50% for end of day account balance of ₹ 50 Lacs & above.

Kotak Mahindra Bank

W.e.f. May 25, 2020, interest rate on daily balances in Savings Account stands revised as follows: Daily balances above Rs. 1 lakh will earn 4% interest p.a. and daily balances up to Rs. 1 lakh will earn 3.50% interest p.a. The interest rates mentioned are applicable for Resident Accounts only.

Recommendation

This my opinion after uses of both banks saving account. Both the banks are tech giant. Their mobile banking apps are best as compare to other banks in private as well as public sector.

I will recommend you to go for ICICI Bank. I love using its iMobile App. You can fulfil all your needs through a single Mobile app.

If there is a question in your mind that why I have preferred ICICI Bank over Kotak Bank? Then my answer is iWish RD Account provided by ICICI Bank.

iWish RD is a unique product that is offered by ICICI Bank. No other banks in private sector as well as public sector offers product like this.

Under iWish RD, ICICI Bank provides you facility that you can deposit any amount of money even Rs.1 at any point of time. You don’t need to deposit a fix amount on every fix time period.

They also provide round off facility with iWish RD. That means if you will do any transaction from your saving account then you can allow iWish RD to round off that transaction and add rounded off amount to your iWish RD.

For example if you have done a transaction of Rs. 955 from your saving account for any purpose like sopping or bill payment etc. and if you have activated your round off facility nearest 50 then Rs. 45 will automatically be funded to your iWish RD account from your saving account.

All are the above reason for my recommendation to you for opening saving account with ICICI Bank.

Which saving account I should go for? I will recommend you to go for Insta Save FD Account.

If you want to apply for ICICI Bank Insta Save FD Account then click here.

If you want to know about derivative then click here.