Table of Contents

Meaning of Future Contract

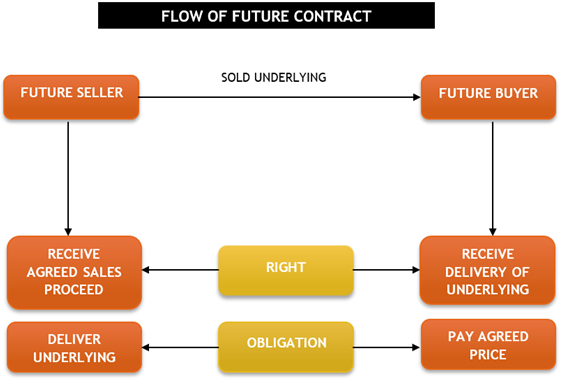

Future contract is a derivative contract under which two parties are agreed to buy and sell an underlying asset at future date on agreed upon price. This derivative contract provides both parties a right and an obligation.

Future contracts are quoted on stock exchange and these derivative contracts are fully standardized.

Under future contract both the parties are required to pay margin to the exchange. Margin is helpful for exchanges to mitigate the default risk.

Under future contract, there is a provision of daily settlement. Daily settlement price of contract is decided at the close of every trading day and it is also required for deciding margin money.

Future buyer has right to receive the delivery of underlying asset and has an obligation also to pay the agreed price. Similarly, Future seller has right to receive the agreed price but has an obligation to deliver the underlying asset on specified date. This is a big difference between option contract and future contract.

For example, you are a speculator and you are observing the share price of Tata Motors. Current share price of Tata Motors is Rs. 200 per share. After observation you come to conclusion that the share price of Tata Motors will fall within 1 month. To take the advantage of this you can enter into future contract to sell the share of Tata Motors on a price of Rs.200 per share after 1 month. Suppose if the price of share falls to Rs. 85 after 1 month then you will make profit of Rs. 115 per share.

Key Features of Future Contract

- Traded on stock exchange like National Stock Exchange (NSE) or Bombay Stock Exchange (BSE)

- Standardised contract

- Parties can exit the contract before the expiry of contract that means squire up is allowed

- Margin is required

- Daily settlement of contract

- Default risk would be on stock exchange

- Less risky as compare to forward contract

Opening, Closing and Settlement Price

Opening Price: Price at which contract traded at the beginning of a trading session.

Closing Price: Price at which contract traded at end of a trading session.

Settlement Price: There are two types of settlement price-

- Daily Settlement Price: It is a closing price of a future contract, determined at the end of each trading day and according profit or loss settled. According to NSE, closing price for a futures contract shall be calculated on the basis of the last half an hour weighted average price across exchanges of such contract

- Final Settlement: It is the price at which future contracts are settled on the last trading day of future contract. According to NSE, final settlement price would be Closing price of the relevant underlying security or index in the Capital Market segment across exchanges, on the last trading day of the futures contract.

Settlement Mode

Future contract can be settled in two ways- Physical Settlement and Cash Settlement. In case of future or option contract, parties may either agree for delivery of underlying asset (physical settlement) or may opt for net cash settlement.

Physical settlement: Under this contract actual delivery of underlying asset takes place. Under physical settlement parties are bound by an agreement that they will deliver or take delivery of an underlying asset on a future agreed date.

Physical settlement mostly happens in case of commodities but can also occur in case of another underlying asset.

For example, if you buy 10 future contracts of wheat at a price of Rs. 700 per contract. On expiry of future contract, price of wheat went jumped to Rs. 1000.

Then in this case seller is obligated to deliver you wheat at agreed price of Rs. 700 per contract and you are obligated to pay the amount Rs. 7000 (700 * 10).

At the end of contract, you will make profit of Rs. 3000 [(1000-700) *10].

Cash Settlement: Under this contract actual delivery of contract does not take place. Contracts are settled on the net position basis.

Suppose in above example if parties are agreed for cash settlement then at the end of the contract the seller will pay to the buyer net settlement amount that is Rs. 3000 (Profit of buyer at the end of the contract).

In above example, suppose if price at the end of the contract falls to Rs. 400 per contract. Then in this case buyer of the contract will pay Rs. 3000 to seller [(700 – 400) * 10] (Profit of seller at the end of the contract).

Tick Size

Exchanges limits the minimum price movement of a trading instrument. That means during trading session, the minimum price by which an instrument can move up or move down. This minimum price is called Tick or Tick Size.

For example, if tick size of Bank Nifty Future on NSE is 5 paisa and contract size is 40 units. Then tick value = Tick Size * Contract Size = INR 2 That means for every single tick price movement per contract settlement amount would be INR 2.