Table of Contents

What is Futures Margin?

Futures margin is a precondition to enter into future contract. Under future contract two parties are agree to sell and buy an underlying asset on future date at a pre-determined price. But if either party default then exchange would be responsible for other party. Therefore, to mitigate the risk of default exchanges require investors to pay margins which is known as futures margin.

Futures margin is required to be paid by both parties. Here margin work like a shield against risk of default.

Types of Futures Margin

There are three kind of futures margin –

Initial Margin

This is a futures margin; you are required to pay while entering into a future contract. Initial margin is required to maintain throughout future contract period. Initial margin’s calculation is based on 99% VAR (Value at risk) over a one-day time horizon. It basically means that your initial margin should be enough to cover loss of your position in 99% cases. Initial margin collected should be large enough to cover single day loss.

As per SEBI, the probable change in the price of the underlying over the specified horizon i.e. ‘price scan range’, in the case of Index futures and Index option contracts, are based on 3 standard deviation, where standard deviation is the volatility estimate of the Index. The volatility estimate i.e. standard deviation is computed as per the Exponentially Weighted Moving Average methodology. This methodology has been prescribed by SEBI.

In case of option and futures on individual stocks the price scan range is based on three and a half standard deviation, where ‘standard deviation’ is the daily volatility estimate of individual stock.

Marking-to-Market (MTM) Margin or Variation Margin

This is second type of futures margin. At the end of each trading day the balance in margin account is adjusted according to the future price movement to reflect the gain or loss of the parties entered into the contract. This process is called Marking to Market.

Each day prices moves up and down and accordingly margin money value gets adjusted to that extent under future contract.

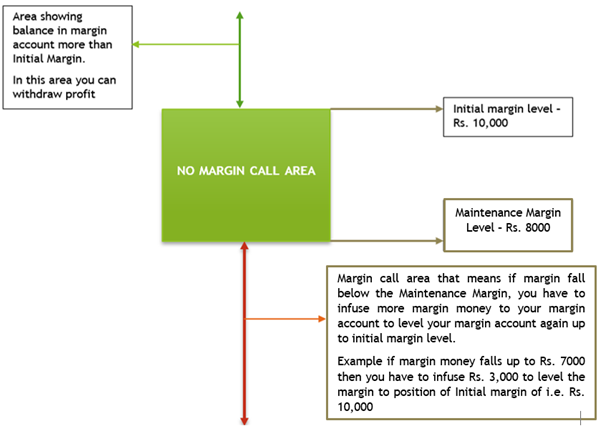

Maintenance Margin

This futures margin is the minimum amount that must be maintained in margin account throughout the future contract. If the balance in futures margin account falls below the minimum level (i.e. Maintenance Margin) then right party will receive a margin call from clearing house to pump the money again in margin account up to Initial Marin level.

Example- 1

On September 2 Mr. Ravi buys 10 contracts of Dec Reliance Future at 1240. Each contract covers 50 shares. Initial margin was set at Rs. 2400 per contract while maintenance margin was fixed at Rs. 2000 per contract. Daily settlement prices are as follows:

Sep 2 ………………. 1218

Sep 3 ………………. 1266

Sep 4 ………………. 1230

Sep 5 ………………. 1246

Mr. Ravi meets all margin calls. Whenever he is allowed to withdraw money from the Margin account, he withdraws half the maximum amount allowed. Compute for each day-

- Margin Call

- Profit or loss on the contract

- Balance in the account at the end of the day

Answer

Initial Margin = 2,400 * 10 = 24,000

Maintenance Margin = 2,000 * 10 = 20,000

| Days | Opening Balance in Margin A/c | MTM | Maximum Permissible Amount that can be withdrawn | Amount Withdrawn | Margin Call | Closing Balance in Margin A/c |

| Day 1 | 24,000 | (1218 – 1240) * 10 * 50 = -11,000 | NA | NA | + 11,000 | 24,000 |

| Day 2 | 24,000 | (1266 – 1218) * 10 * 50 = +24,000 | 24,000 | 12,000 | NA | 36,000 |

| Day 3 | 36,000 | (1230 – 1266) * 10 * 50 = – 18,000 | NA | NA | +6,000 | 24,000 |

| Day 4 | 24,000 | (1246 – 1230) * 10 * 50 = +8,000 | 8000 | 4000 | NA | 28,000 |

Have you understood how the flow of margin is working under future contract? In above example Initial Margin is Rs. 24,000 and Maintenance Margin is Rs. 20,000. Now just keep in your mind the concepts of all margin and try to remember margin flow chart.

You know the concept that if your balance in Margin a/c will go below to the Maintenance margin level then you have to infuse more money to your margin account to reach out again up to the initial margin level.

On Day 1 Mr. Ravi bears a loss of Rs. 11,000 and after adjustment of loss Margin balance would be Rs. 13,000 which is below the Maintenance Margin of Rs. 20,000 therefore now Mr. Ravi will get a margin call to infuse Rs. 11,000 to again reach out the level of Initial Margin. Similarly, on Day 3, Mr. Ravi bears a loss of Rs. 18,000 and after adjustment of loss Margin balance would be Rs. 18,000 (36,000 – 18,000) which is below the Maintenance Margin of Rs. 20,000 therefore now Mr. Ravi will again get a margin call to infuse Rs. 6,000 to again reach out the level of Initial Margin.

Example- 2

Sensex future are traded at multiple of 50. Consider following quotation of Sensex futures in 4 trading days during May, 2020:

| Date | Closing Price |

| 4-5-2020 | 9296.50 |

| 5-5-2020 | 9294.40 |

| 6-5-2020 | 9230.40 |

| 7-5-2020 | 9212.30 |

Mr. Ravi bought one Sensex futures contract on May 4 at the price of 9296.50. The average daily absolute change in the value of contract is Rs. 10,000 and standard deviation of these changes is Rs. 2000. The Maintenance Margin is 75% of initial margin. You are required to determine the daily balance in the margin account and payment on margin calls, if any.

Answer

As per SEBI, the probable change in the price of the underlying over the specified horizon i.e. ‘price scan range’, in the case of Index futures and Index option contracts are based on 3 standard deviation.

Initial Margin = Mean of the price change + 3 Standard Deviation

= Rs. 10,000 + 3 * 2000

= Rs. 16,000

Maintenance Margin = 16,000 * 75% = 12,000

| Date | Opening Margin Balance | MTM | Margin Call | Closing Margin Balance |

| 4-5-2020 | 16,000 | Nil | Nil | 16,000 |

| 5-5-2020 | 16,000 | (9294.40 – 9296.50) * 50 = – 105 | Nil | 15,895 |

| 6-5-2020 | 15,895 | (9230.40 – 9294.40) * 50 = – 3,200 | Nil | 12,695 |

| 7-5-2020 | 12,695 | (9212.30 – 9230.40) * 50 = – 905 | 4,210 | 16,000 |

On date 7-5-2020, Balance in margin a/c goes below to the maintenance margin level of Rs. 12,000. Therefore Mr. Ravi get a call to infuse Rs. 4,210 to margin a/c to reach out again at Initial margin level.