Table of Contents

What is Triangular Arbitrage?

Triangular Arbitrage is the result of mis-match of exchange rate of three currencies. Under this mechanism arbitrageur takes advantage of discrepancy among three different currencies in the foreign exchange market. Triangular arbitrage may exist only when derived or implied cross rate is not equal to quoted exchange rate.

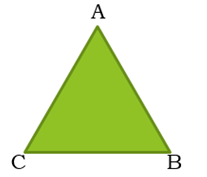

Suppose there are three currency i.e. ‘A’, ‘B’ and ‘C’ then in triangular arbitrage, if there is any arbitrage opportunity, the arbitrageur will sell currency ‘A’ and buy currency ‘B’, then sell currency ‘B’ and buy currency ‘C’ and then sell currency ‘C’ and buy currency ‘A’. It means triangular arbitrage involve three trade that’s why it is known as triangular arbitrage.

Calculation Step

- Calculate implied or derived cross rate

- Compare implied cross rate with quoted exchange rate and select higher bid and lower ask

- Calculate profit which is difference of above selected rates

- Then start triangular arbitrage by selling that currency which is reported in profit.

- Sell 1 unit of ‘A’ and buy ‘B’ * Sell 1 unit of ‘B’ and buy ‘C’ * Sell 1 unit of ‘C’ and buy ‘A’ = ****** ( – ) Initial Investment 1 = Profit

Special Point

- We should start with the currency in which profit is reported

- We should start our action from the market in which buy position is to be created as per Step III.

Example

1 USD = JPY 110.25/ 111.10

1USD = NLG 1.6520/ 1.6530

1NLG = JPY 68.30/ 69.00

Decide whether an opportunity for currency arbitrage exists from the above-mentioned quotes.

Ans: –

Note – If no direction is given like two quotes in one market and one in quote in another market or Investment currency, then ideal process would be to eliminate USD to get derived cross rate. IF USD is not appearing at all then conceptually, we can start with any currency.

Step-I Calculate cross rate: –

1 NLG = JPY 110.25/1.6530 111.10/1.6520

= JPY 66.70 67.25

Step-II Compare cross rate with quoted rate

Derived – 1 NLG = JPY 66.70 67.25

Quoted – 1 NLG = JPY 68.30 69.00

We can buy at 67.25 and sell at 68.30 to make profit

Profit = 68.30 – 67.25 = 1.05 JPY per NLG

Step-IV Action- (As profit reported in JPY we have to start from here)

Profit = ((Sell 1 unit of JPY buy USD * Sell 1 unit of USD & buy NLG * Sell 1 unit of NLG and Buy JPY) – 1)

= ((1/111.10) * 1.6520 * 68.30) – 1

= .0156 JPY per JPY investment

Note: Before reading this topic you must read two point arbitrage for better understanding.